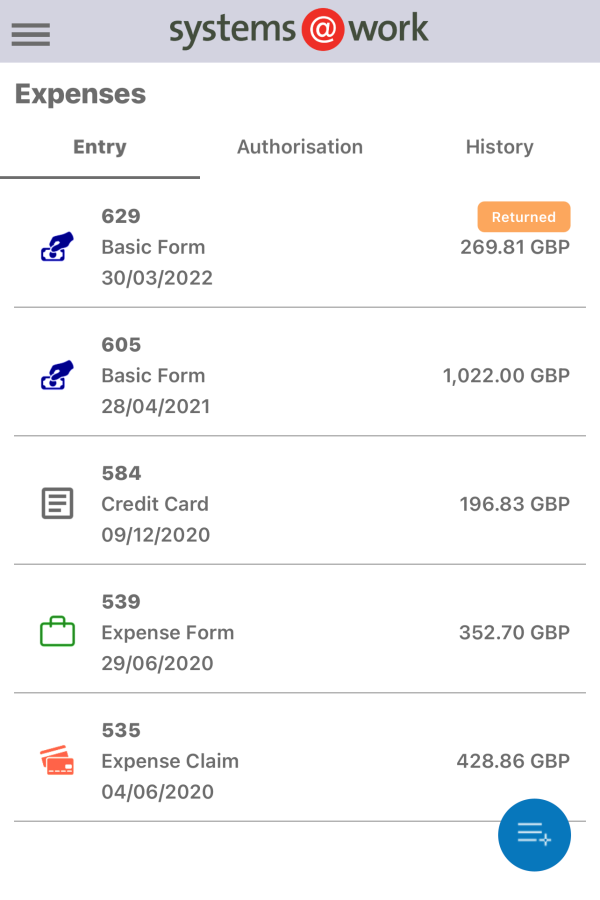

Expense Management

Control your expenses whatever your industry

Foreign and domestic expenses, Advances, Travel Requests, Budgets, Mileage and Allowances, Credit Card Processing, Integration with any Financial System.

– Timesheets, Expenses, Billing and Budgeting

Easy-to-use and adaptable software

Cloud or On Premise

Control your expenses whatever your industry

Foreign and domestic expenses, Advances, Travel Requests, Budgets, Mileage and Allowances, Credit Card Processing, Integration with any Financial System.

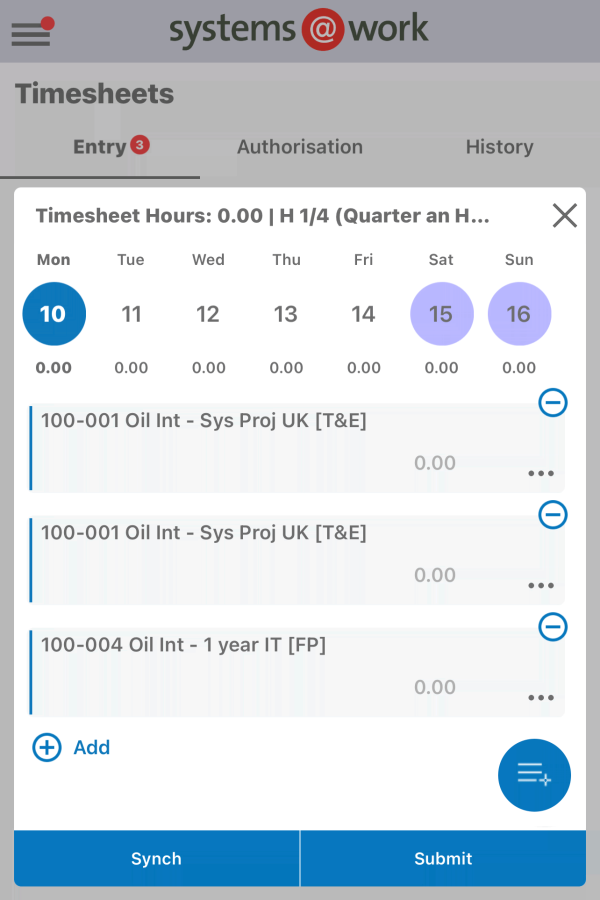

Capture and report on project time by task and multiple activity fields

Flexible Timesheet Periods. Flexible Entry Units. Optional hierarchical levels by project, task and activities. Optional Timesheet Types by department. Authorization by line manager and/or project manager. Actuals against budget.

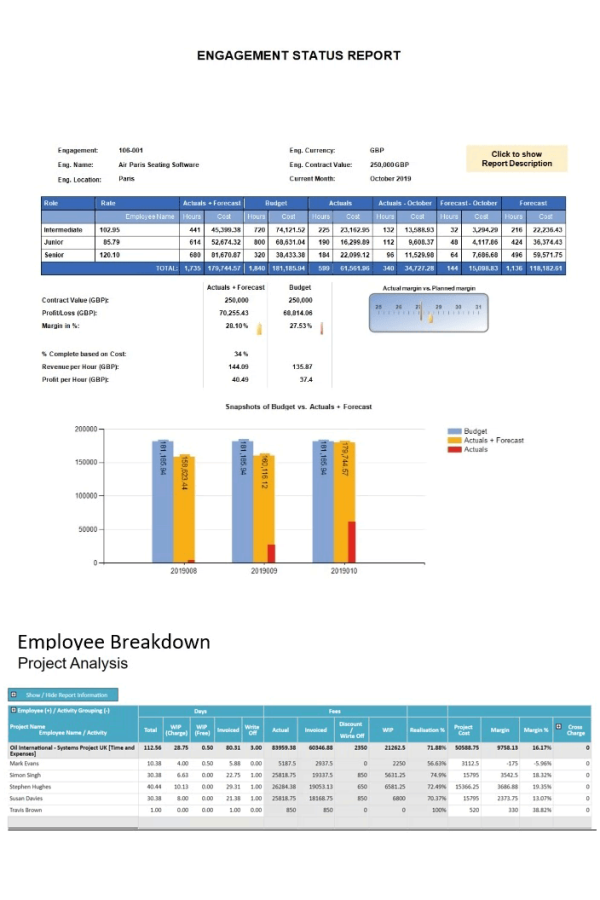

Understand your Professional Services firm from every angle

Utilisation, Realisation, Achieved Fee Rates and Gross Margin by Project/Task/Activity/Employee. Time & Materials, Fixed Price, Scheduled and Ad-Hoc Invoices. Planning by Project and Employee. Actuals against Budgets and Budget Revisions.

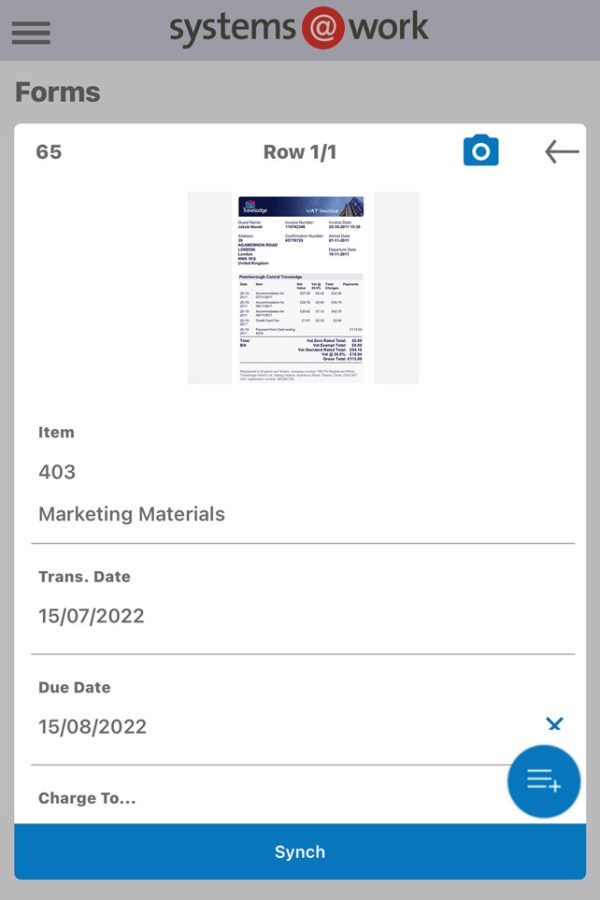

Automate purchase invoice data extraction, cost allocation, authorization and accounting

Intelligent document data extraction without the need for template definition. Multiple conditional authorization workflows. Export to accounting.

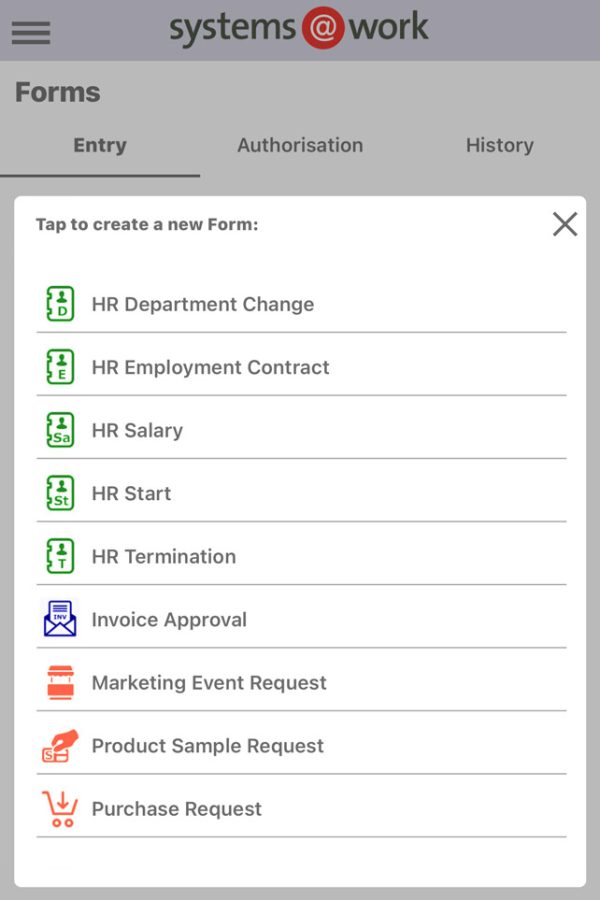

Manage your business workflow

Unlimited definable forms for data capture, workflow, export and reporting. Purchase requests. Employee set up. Sample requests. Invoice registration. Mileage forms. Loan requests. Absence requests. Etc.